By Suresh Unnithan

Since Narendra Modi assumed office in 2014, India’s foreign policy has been rebranded as a bold shift from Nehruvian non-alignment to a pragmatic “multi-alignment” strategy. Many right-wing supporters argue that this approach has positioned India as a “swing state” in geopolitics, attracting foreign direct investment (FDI) and stabilizing energy costs through discounted Russian oil. However, a closer examination reveals a policy riddled with inconsistencies, undue deference to U.S. pressures, and strategic slip-ups that have alienated neighbours, ballooned trade imbalances, and eroded India’s leverage in key regions. Far from a “seismic shift” bolstering India’s position, Modi’s doctrine has often prioritized short-term optics and commercial gains over long-term political and security interests, leading to tangible setbacks.

From Autonomy to Erratic Multi-Alignment

India’s foreign policy roots in Jawaharlal Nehru’s non-alignment emphasized strategic independence, allowing the country to navigate Cold War blocs while focusing on domestic development. Under Modi, this evolved into the “Modi Doctrine,” emphasizing proactive diplomacy, economic ties, and “Vishwa Guru” aspirations. Yet, critics argue this has devolved into reactive, optics-driven decisions influenced heavily by nationalist politics at home. For instance, Modi’s over 100 foreign visits by 2025 have yielded symbolic wins like G20 hosting, but substantive outcomes are mixed, with border tensions and regional isolation persisting.

The duality in engagements—such as joining the China-led Shanghai Cooperation Organisation (SCO) while deepening ties with the anti-China Quadrilateral Security Dialogue (QUAD)—is often lauded as balanced. However, this “multi-alignment” masks erratic pivots. When Donald Trump initiated tariff threats in his first term, India cozied up to China, offering to “open all doors” for trade. This led to a ballooning trade deficit, soaring from $48.45 billion in FY2014-15 to a record $116.12 billion in 2025, dominated by Chinese imports in electronics and chemicals. Despite post-2020 Galwan clashes, SCO participation hasn’t curbed imbalances, highlighting the limits of this strategy.

Capitulation to U.S. Pressures: Oil, Chabahar, and Economic Costs

Modi’s handling of U.S. relations exemplifies policy flaws. In Trump’s second term (2025 onward), India faced repeated friction, including Trump’s unsubstantiated claims of mediating “Operation Sindoor” with Pakistan and pressuring India to halt Russian oil imports. Under tariff threats, the Modi government halted oil purchases from Venezuela, Iran, and even Russia—despite a 40% discount from Moscow—swelling India’s import bill significantly. This defied earlier defiance of Western sanctions post-2022 Ukraine invasion, where Russian crude imports rose to 40% of India’s total, saving billions. By late 2025, imports from Russia plummeted under U.S. pressure, forcing India to seek alternatives like Venezuelan crude, but at the cost of energy security.

A glaring strategic blunder is India’s withdrawal from Iran’s Chabahar port under U.S. sanctions. Developed as a gateway to Afghanistan and Central Asia, bypassing Pakistan, Chabahar offered control over Middle Eastern trade routes spanning over 7,000 km. In 2025, India liquidated $120 million in investments and exited, citing Trump’s 25% tariff threats on Iran trade partners. This not only forfeited strategic leverage but signaled weakness, as India prioritized U.S. ties over regional autonomy.

Bureaucratic Dominance and the Absence of Political Acumen

At the helm are two bureaucrats—External Affairs Minister S. Jaishankar and National Security Advisor Ajit Doval—who wield outsized influence, often overshadowing seasoned politicians. Critics argue they prioritize commercial deals over political strategy, lacking the nuanced understanding needed for complex diplomacy. Jaishankar, a career diplomat, has centralized policy, but his approach—combative rhetoric abroad—has been called “muscular nationalism” that falters under pressure. Doval, with his security focus, has clashed with Jaishankar on China and Pakistan, leading to inconsistent handling. This bureaucratic tilt has compromised India’s foreign policy, as evidenced by failures in neighborhood diplomacy.

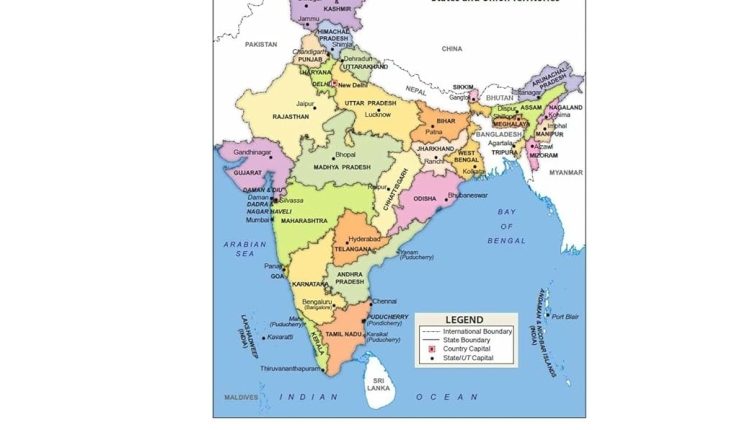

Alienated Neighbors and Rising Chinese Influence

Modi’s “Neighborhood First” policy, intended to strengthen ties through infrastructure and aid, has instead unraveled, fostering widespread alienation and paving the way for China’s encroaching dominance in South Asia. Immediate neighbours like Bangladesh, Nepal, Sri Lanka, Myanmar, and the Maldives have increasingly drifted toward Beijing, viewing it as a counterweight to India’s perceived overreach and “dadagiri” (bullying). This shift is not merely economic but strategic, with China overtaking India as the top trading partner for Pakistan, Bangladesh, Nepal, and Sri Lanka, leveraging its Belt and Road Initiative (BRI) to build ports, roads, and infrastructure that encircle India.

In Bangladesh, the 2024 ouster of Sheikh Hasina amid student-led protests chanting “India Out” exposed deep resentment toward New Delhi’s perceived interference, including support for Hasina’s regime and controversial deals like the Adani Group’s energy projects. By 2025, Bangladesh aligned more closely with China, which became its largest trading partner and arms supplier, investing in ports like Chittagong and Mongla as part of its “String of Pearls” strategy to contain India. Anti-India sentiment surged further in early 2026 following the death of student activist Sharif Osman Hadi, with mobs accusing India of complicity and threatening Indian missions.

Nepal’s relations have soured over border disputes like Kalapani-Lipulekh, where India’s road construction in 2020 sparked accusations of territorial encroachment. Mass protests in 2025 toppled the government, with Nepal increasingly turning to China for infrastructure and as a hedge against Indian influence, despite deep cultural ties. Similarly, Sri Lanka’s economic crisis has deepened its reliance on Chinese debt-trap diplomacy, with BRI projects like Hambantota port leased to Beijing, eroding India’s “Neighborhood First” efforts despite attempts to upgrade Colombo port.

In Myanmar, ongoing civil war since the 2021 coup has led to refugee influxes into India’s northeast, straining resources, while China exploits the instability with investments in Kyaukpyu port. The Maldives exemplifies outright rejection: President Mohamed Muizzu’s 2023 election on an “India Out” platform prompted the withdrawal of Indian troops by 2025, tilting Male toward China for military and economic ties. Even Bhutan, traditionally aligned with India, reconsidered ties with China in 2025 amid border talks, signaling a broader regional multipolarity. These developments highlight India’s eroding influence, as smaller nations hedge against its dominance by embracing Beijing, fracturing South Asia and complicating New Delhi’s global ambitions.

Worse, the U.S. and China are seen supporting Pakistan—India’s sworn enemy—through aid and diplomacy, exposing Modi’s inability to isolate Islamabad.

Strained Ties with Russia: From Ally to Uneasy Partner

Russia, long hailed as India’s “all-weather friend,” has seen its relationship with New Delhi devolve into an uneasy partnership marked by stagnation, external pressures, and diverging geopolitical interests. Despite symbolic gestures like President Vladimir Putin’s December 2025 visit to India—the first since 2021—the ties are described as paradoxical: resilient in traditional spheres like defense but stagnant in new areas, with no clear path forward. The 23rd India-Russia Annual Summit produced affirmations of a “special and privileged strategic partnership” and pledges for $100 billion in bilateral trade by 2030, including Arctic cooperation and BRICS support for India’s 2026 chairship. However, underlying strains persist, fueled by U.S. sanctions and tariffs that forced India to slash Russian oil imports by 38% in October 2025, reversing the post-2022 surge from under 1% to 40% of India’s crude.

No major defence deals emerged from the summit, such as procurements of fighter jets or additional S-400 systems, highlighting India’s diversification away from Russian arms amid Moscow’s war-related production delays and India’s push for indigenous manufacturing. Russia’s growing proximity to China—India’s primary rival—and to Pakistan further exacerbates tensions; Moscow has conducted joint military exercises with Beijing and supplied arms to Islamabad, moves that undermine India’s security interests. Payment complications from Western sanctions, trade imbalances favoring Russia, and the EU’s 18th sanctions package—set to ban refined Russian petroleum products from third countries like India by January 2026—add economic friction. Putin’s visit, laden with optics like Modi’s personal airport welcome, was partly a defiance of U.S. pressure, but experts warn of a “managed decline” as India deepens Western ties while Russia aligns eastward. This drift alienates a historic ally, leaving India vulnerable in a multipolar world where Moscow’s support on issues like Kashmir or UN reforms can no longer be taken for granted.

Economic Gains Mask Strategic Losses

The provided analysis touts GDP growth from $1.86 trillion in 2014 to $3.89 trillion in 2025 and FDI inflows rising 125%. Yet, these mask vulnerabilities: China’s trade dominance, energy insecurity, and regional isolation. Multi-alignment has fueled growth but at the cost of autonomy, as India navigates U.S.-China tensions without a coherent long-term vision.

In sum, Modi’s foreign policy, led by bureaucrats focused on commercials, has been inconsistent and capitulatory, losing strategic ground to China and alienating allies. This is particularly evident in Modi’s China policy, where public rhetoric starkly contrasts with on-ground realities. In a 2025 speech, Modi publicly denounced imports of Chinese goods, taking a veiled swipe at “small-eyed Ganesh idols” from abroad—whose “eyes don’t even open properly”—as part of a broader call to boycott foreign products and champion “Make in India” during festivals like Ganesh Puja. He urged traders and citizens to prioritize local goods, framing it as a patriotic duty to curb “China dumping” and boost domestic manufacturing. Yet, this nationalist posturing has proven hollow: despite border clashes, apps bans, and investment scrutiny post-Galwan, India’s trade deficit with China has ballooned to a record $116.12 billion in 2025, driven by unchecked imports of electronics, chemicals, and machinery that fuel the very dependency Modi decries. Exports to China grew modestly to $19.75 billion, but this pales against the influx, highlighting a yawning gap between Modi’s fiery speeches and policy practice—where economic pragmatism trumps security concerns, allowing Beijing to deepen its economic hold while India forfeits leverage. India needs seasoned political leadership to reclaim its independent stance, bridging this say-do divide, or risk further erosion in a multipolar world.

Inputs from Nanditha Subhadra