Trump’s Crude Coup: Capturing Maduro, Running Venezuela, and Looting the World’s Largest Oil Reserves

By Suresh Unnithan

The United States faces real economic headwinds heading into 2026, with real GDP growth forecasts ranging from 1.9% to 2.6% amid risks from tariff policies, inflation pressures, and unemployment hovering near 4.5–4.7%, and softening consumer demand. Against this backdrop, the Trump administration launched a high-stakes military operation on January 3, 2026—Operation Absolute Resolve—that has sparked widespread debate over motives, legality, and consequences.

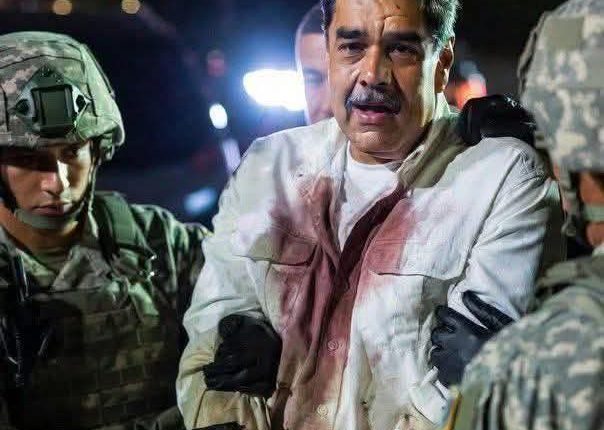

The raid involved airstrikes on military sites across northern Venezuela, including La Carlota airfield and Fuerte Tiuna, followed by helicopter assaults in Caracas. U.S. Special Forces captured President Nicolás Maduro and his wife, Cilia Flores, with no reported American casualties. The pair was flown by helicopter to the USS Iwo Jima in the Caribbean and then to New York to face longstanding federal charges of narco-terrorism conspiracy and cocaine trafficking. President Trump, addressing the nation from Mar-a-Lago, described the action as a decisive blow against drug networks and stated the U.S. would temporarily “run the country” to ensure a “safe, proper and judicious transition.” He emphasized that major U.S. oil companies would invest billions to rebuild Venezuela’s damaged infrastructure and “get the oil flowing.”

Critics view the operation as resource-driven intervention masked as law enforcement. While the administration points to 2020 indictments accusing Maduro of flooding the U.S. with cocaine via the Cartel de los Soles, many see the timing and explicit oil references as evidence of deeper economic incentives.

Venezuela holds the world’s largest proven crude oil reserves—approximately 303 billion barrels as of year-end 2024, as per the U.S. Energy Information Administration (EIA), OPEC’s 2025 Annual Statistical Bulletin, and the Energy Institute—accounting for about 17% of the global total. This surpasses Saudi Arabia (267 billion barrels), Iran (209 billion), and Canada (163 billion). By comparison, the U.S. has roughly 46 billion barrels in proven reserves. Venezuela’s reserves, mostly heavy crude in the Orinoco Belt, position it as a potential energy giant, yet production has collapsed to around 1 million barrels per day (about 0.8% of global output), far below its pre-2013 peak of over 3 million barrels daily. Sanctions, mismanagement, and crumbling infrastructure have starved the sector of investment; analysts estimate tens of billions of dollars—and years of effort—would be needed for meaningful recovery. Trump’s comments about U.S. firms spending billions to refurbish facilities highlight the economic appeal of accessing this untapped wealth.

The conflict traces back to Venezuela’s nationalization of its oil industry. On January 1, 1976, under President Carlos Andrés Pérez, the government assumed full control, creating state-owned Petróleos de Venezuela (PDVSA) and requiring foreign companies to cede majority stakes or exit. Major U.S. players like Exxon (then Standard Oil of New Jersey), Mobil, and Gulf Oil transferred assets, with compensation provided though disputes lingered. Tensions rose again in 2007 under Hugo Chávez, when restructurings demanded state majority control starting May 1. ExxonMobil and ConocoPhillips refused, leading to expropriations; Exxon won $1.6 billion in arbitration, while ConocoPhillips secured nearly $9 billion—awards Venezuela has not fully paid. Chevron remains the only major U.S. operator, producing around 140,000 barrels per day under restricted licenses as of late 2025. This history underpins claims of “stolen” assets, but it also underscores a nation’s sovereign right to manage its resources under international law.

America’s economic backdrop adds context to the timing. The U.S. showed strength in 2025, with third-quarter annualized growth at 4.3%. Yet 2026 projections are cautious: Goldman Sachs forecasts 2.6% (potentially front-loaded by tax cuts but offset by tariffs), while consensus estimates range from 1.9–2.2%, with the Conference Board noting weakening demand and PCE inflation risks above 3% early in the year. Unemployment could rise toward 4.7%. In this environment, securing access to Venezuela’s reserves could offer energy security and price relief—though history shows such interventions (Iraq, Kuwait) often bring instability and high costs without sustained benefits.

The capture has invoked sharp international criticism as a breach of sovereignty. The United Nations Secretary-General expressed deep alarm, calling it a “dangerous precedent” and stressing respect for the UN Charter. Leaders from Brazil (Lula da Silva), Mexico, France, Spain, and others condemned the use of force, labelling it a violation of international law. Russia and Iran described it as aggression. The EU urged restraint while reiterating Maduro’s lack of legitimacy, and protests have erupted worldwide.

This episode echoes past U.S. actions where resource interests appeared central—from the 1953 Iran coup over oil to the 2003 Iraq invasion amid debated motives. Trump’s explicit focus on oil investment and “taking wealth from the ground” makes the parallel hard to ignore, even if framed as combating narco-terrorism.

The abduction of a sitting president and his wife raises thoughtful questions about international norms and long-term stability. While the charges against Maduro are serious, the military method and immediate pivot to U.S. control and corporate involvement invite scrutiny. Venezuela’s vast reserves belong to its people; any path forward must prioritize diplomacy, sovereignty, and genuine transition over unilateral action. True resolution lies in multilateral dialogue—not in operations that risk eroding global order for short-term gains.